For the first letter of 25, let’s cast our gaze backwards, to the hurried weeks before our move from San Francisco to Amsterdam in 2023. With many appliances not fit for European voltage and ski racks and Thule boxes that wouldn’t make sense in our new, car-less Dutch reality, I organized a bit of a Craig’s List sales bonanza.

I photographed each item against the brilliant green of the fake lawn in the backyard. Attention was paid to the lighting and the product positioning, and I like to think that I got quicker responses and higher value sales as the result of it.

Vinted is here to let me know I was wrong.

The wildly successful Lithuanian second-hand marketplace is taking advantage of two key behaviors in the Millenial/Gen-Z demographic: a growing desire to shop second-hand goods before looking at new, and their ambivalence when it comes to how those goods are presented.

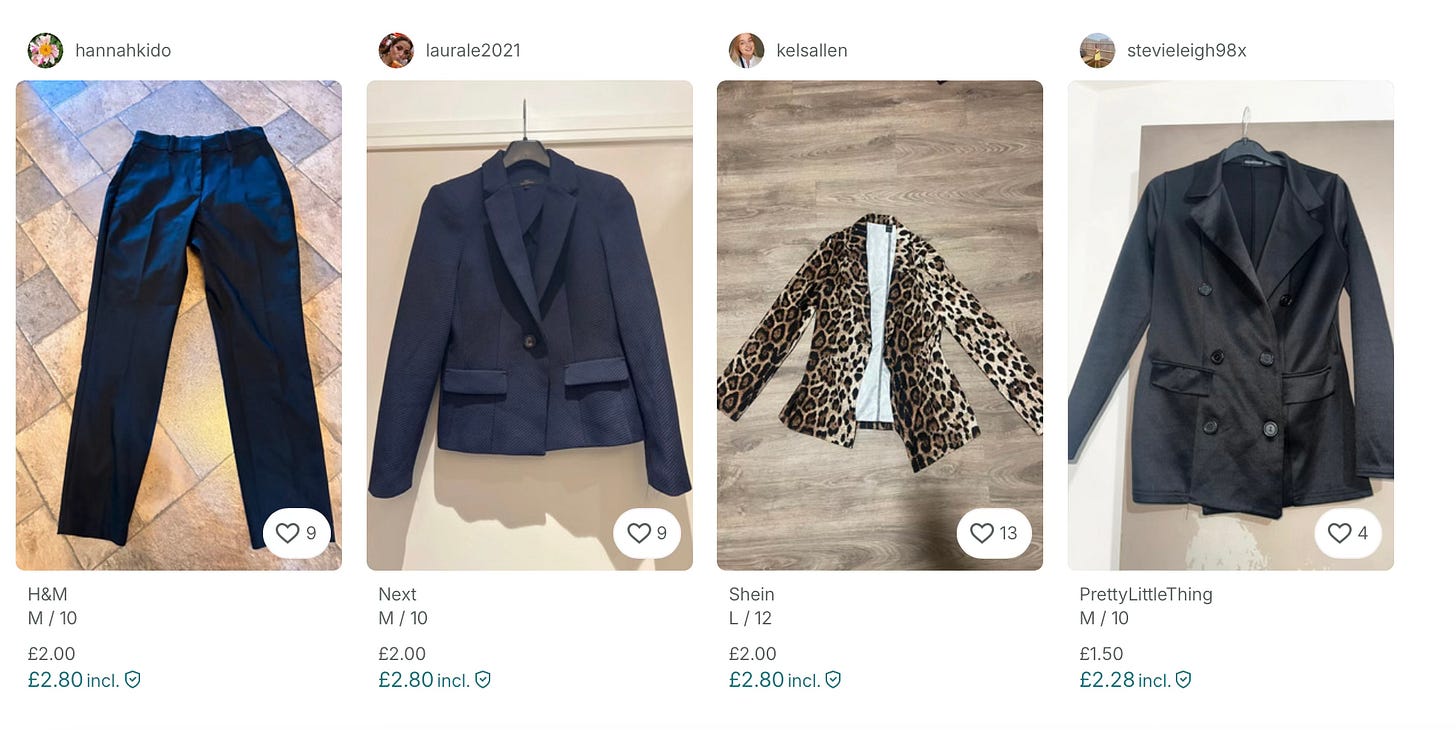

Products on the peer-to-peer platform are splayed on floorboards, hang haphazardly from hangars, and are set against some interesting carpet choices. And it doesn’t seem to matter. In 2023, Vinted Group posted more than €590m in revenue, 61% higher than the year before. The 15-year-old brand holds a sizeable advantage over competitors like Vestaire Collective and DePop in the UK and EU, especially among female shoppers.

Those competitors offer differentiation: Vestaire coming across as a stylish, considered Rent the Runway peer, and DePop vocal about the circular economy.

Vinted appears bereft of any clear brand position beyond convenience and value. This spares them the effort of finding original photography of the products or hiring junior designers to clean the visual assets for each item (or getting an AI tool to do it).

But that refusal to invest in brand might not hold up well when the brands, whose very items are being sold on their platforms, come for them.

And that time is nigh.

Resale, currently growing at 5x the rate of overall retail, is predicted to be a a $250 billion industry by 2027 (Trove Report, 2024). Even if those numbers feel a little grandiose, the gilded outline of the market has already appeared, shaped both by the changing preferences and earning potential of a demographic, and government regulation.

The former rewards early arrivers like Vinted, but the latter is what pushes the behemoth brands in to a new line of business. According to that report I cited above, new customer acquisition is one of the biggest benefits of re-commerce, with at least 30% of the buyers of preloved products new to the brand themselves.

But there is also an incredible storytelling opportunity here. As friend-of-the-letter Ross Martin pointed out to me once, we’re emotional creatures and we assign meaning to things. Not towels, or soap, necessarily, but a favorite pair of boots, our cars, a jacket. Every item on a resale site carries with it a story.

And yet the big brands are crap at telling them.

Few have followed Patagonia’s benchmark with Worn Wear, where preloved items are celebrated, and the Big Brand social handle carries episodes of its “Stories We Wear” format. Those that do well in this new market commit completely: not just in their marketing, but by re-hauling their retail touchpoints, e-commerce and supply chains.

“Sustainability” is such a loaded word in retail branding, part of a dated vocabulary that no longer resonates with a savvy consumer skeptical of its validity and wary of being chided. In its stead, re-commerce offers companies a new word: stories.

It feels like one of the rare instances where branding can pave the way for a new vertical while doing the work brand was meant to do: provoking an emotional reaction from us.

Here are a couple doing it nicely.

Rimowa 🧳 LVMH took a majority stake in the 126-year-old German luggage maker 8 years ago, and the burnish has been full on since. Lots of sexy partnerships that signal premium, elite, and globe trotter: Lewis Hamilton, Kendall Jenner, Virgil Abloh, etc. But the last year has seen its Instagram handle also carry short videos of the not-as-glamorous employees that refurbish battered Rimowa suitcases, and the emergence of their owned marketplace for preloved products, Rimowa Recrafted. Somewhat ironically, their quality is so enduring, there aren’t a lot of refurbished suitcases for sale (Maybe their trade-in program also needs work). But the site offers you the chance to sign up and be notified when new ones come in. And the opportunity is clear: acquire new customers previously hesitant over the price tag and signal quality, durability, and craftsmanship to them and everyone else. Most charming, the stickers that owners apply to distinguish their otherwise anonymous silver cases: documenting travels, memories, and their hobbies and passions. Check out this post by Japanese creative Shinya Katama: a loving tribute to the stickers applied by a previous owner whose tastes mirrored his. And this is where the storytelling opportunity is wide open, and should be taken more confidently. Who owned Katana’s suitcase before? Where has it gone, what has it seen, and why is it covered in those crazy-ass stickers?

I imagine the biggest debates within Rimowa center around whether preloved detracts from the luxury glow the company has worked so hard to conjure. But it feels like that’s simply ignoring a growing reality: most people want to buy less stuff, and if they can pay a little less for a lot more quality than they’ll think fondly of you the next time the buy new. Even better: Give them a story to tell when they talk about it.

Diane von Fürstenberg 👗 If your brand pillars include “timelessness” or “heritage”, you’ll be able to tell a re-commerce story rather seamlessly. Think of Wüsthof Knives, Le Creuset cookware, or Levi’s Jeans. Luxury fashion? That’s a bit trickier. How do you sell a dream of hand-crafted (pricey) exclusivity on your main channels, and then open up a back door for people to get them for cheaper second-hand? There are a few labels that have already begun navigating this path. Since 2021, Oscar de La Renta’s elegant solution has been Encore, an occasional drop model (à la streetwear) with a limited collection of gowns, jewelry and cocktail dresses that have appeared on runways, red carpets, and other major events in the label’s storied history. But that approach feels more high-end vintage than planet-saving. Not so, Diane von Furstenberg, whose entire brand is about maximizing the mileage of one, iconic product. Created in 1974, her Wrap Dress became an enduring signal of female empowerment, managing to redefine luxury as something both accessible and versatile. So, too, does DVF’s repositioning of it. The brand showcases its heritage by allowing customers to buy archival designs. Most charming, however, is a Missed Connections tab, where customers can fill out a Classified Ad format for the dress they’re after and get notified if another customer happens to be selling it. That’s not just a subtle way to drive repeat visits, but perhaps the beginning of a community as well. You can see how this can be drawn out further: the NYC store last year hosted a ReWrap pop-up during Earth Month. Levi’s has a tab focused specifically on 501s on its nicely presented Levi’s Secondhand site, but nothing like the all-in focus of DvF.